tax benefit rules for trusts

In general the trust must pay income tax on any. The UK Government supports the use of employee.

Year End Planning Tips By The Numbers The Closing Quarter Of The Year Is A Great Time To Review You Relationship Management How To Apply Investment Portfolio

Taxes on non-grantor trusts If grantor trust rules dont apply then the key question becomes who is entitled to trust income.

. Manage the trust on a day-to-day basis and pay any tax due decide how to invest or use the trusts assets If the trustees change the trust can still continue but there always has to be at. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Is the trust.

Ad Fast Friendly and Dependable Service for Incorporating in Wyoming. These new tax rules are referred to as the disguised remuneration rules. The estate tax is levied against the estate of a.

Amount did not reduce the amount of tax imposed by Chapter 1 of the Code. Because trusts are not subject to double taxation either principal or income on which the trust paid taxes can be distributed tax-free to the beneficiaries. As a result of the Tax Cuts and Jobs Act TCJA a non-resident alien NRA is now permitted to be a potential current beneficiary of an Electing Small Business Trust.

If the trust or estate has taxable income in a given year the fiduciary may elect to treat charitable distributions made in the subsequent year as paid in the first year. If a trust has. Nongrantor trusts are generally subject to tax only to the extent that they accumulate taxable income.

This could put you into a lower tax bracket even if the trust is taxed at the lowest income tax rate. The Benefits of Estate Taxes. From Fisher Investments 40 years managing money and helping thousands of families.

Tax Changes for Estates and Trusts in the Build Back Better Act BBBA httpscrsreportscongressgov taxable estate and any distributions made by the trust to the. For example if a single taxpayer has 250000 of dividends and no other income 50000 will be subject to the 38 NIIT which is an additional tax of 1900. Section 111 partially codifies the tax benefit rule which generally requires a taxpayer to include in gross income.

General Rule Who Pays the Tax on EstateTrust Step 1 Income to Beneficiaries. Clean Aged Shelf Companies Available Now. Income tax charitable deductions for trusts and estates are governed by Sec.

A health and education exclusion trust heet can be used to pay for the educational or medical expenses of grandchildren with two primary tax benefits. Since trusts enter the highest tax bracket 37 once they exceed 13051 of taxable income in 2021 individuals do not reach this bracket until their taxable income. Trusted Incorporation Services for Over 15 Years.

Encouraging employee share ownership and employee ownership. Ad Follow our easy step-by-step instructions to complete your online Trust-Based Estate Plan. 642 c these rules are substantially different from the rules for charitable contribution.

Chat With A Trust Will Specialist. Built By Attorneys Customized By You. Is the lessor of distribution to beneficiaries or estatetrust income Step 2 Income to Trust.

Distributions made by a trust to the trusts beneficiary pass along. There are various tax rules for beneficiaries of income from trusts depending on whether the trust is revocable or irrevocableas well as the type of income the trust receives.

Pin By Debbie Wolfe On Trusts Revocable Living Trust Revocable Trust Testamentary Trust

How To Use Google Trends For Your Business World Of Wordpress Google Trends Different Words Web Development Design

Http Taxworry Com Basis Of Charge Under I T Act 10 Questions Capital Gains Tax Income Tax Taxact

Pin By Debbie Wolfe On Trusts Sell My House Estate Tax Trust

Portfolio Of The Week Ciaran Hughes Infographic Creative Infographic Glasgow

Taxation Of Private Trust Tax Planning

Exploring The Estate Tax Part 2 Journal Of Accountancy

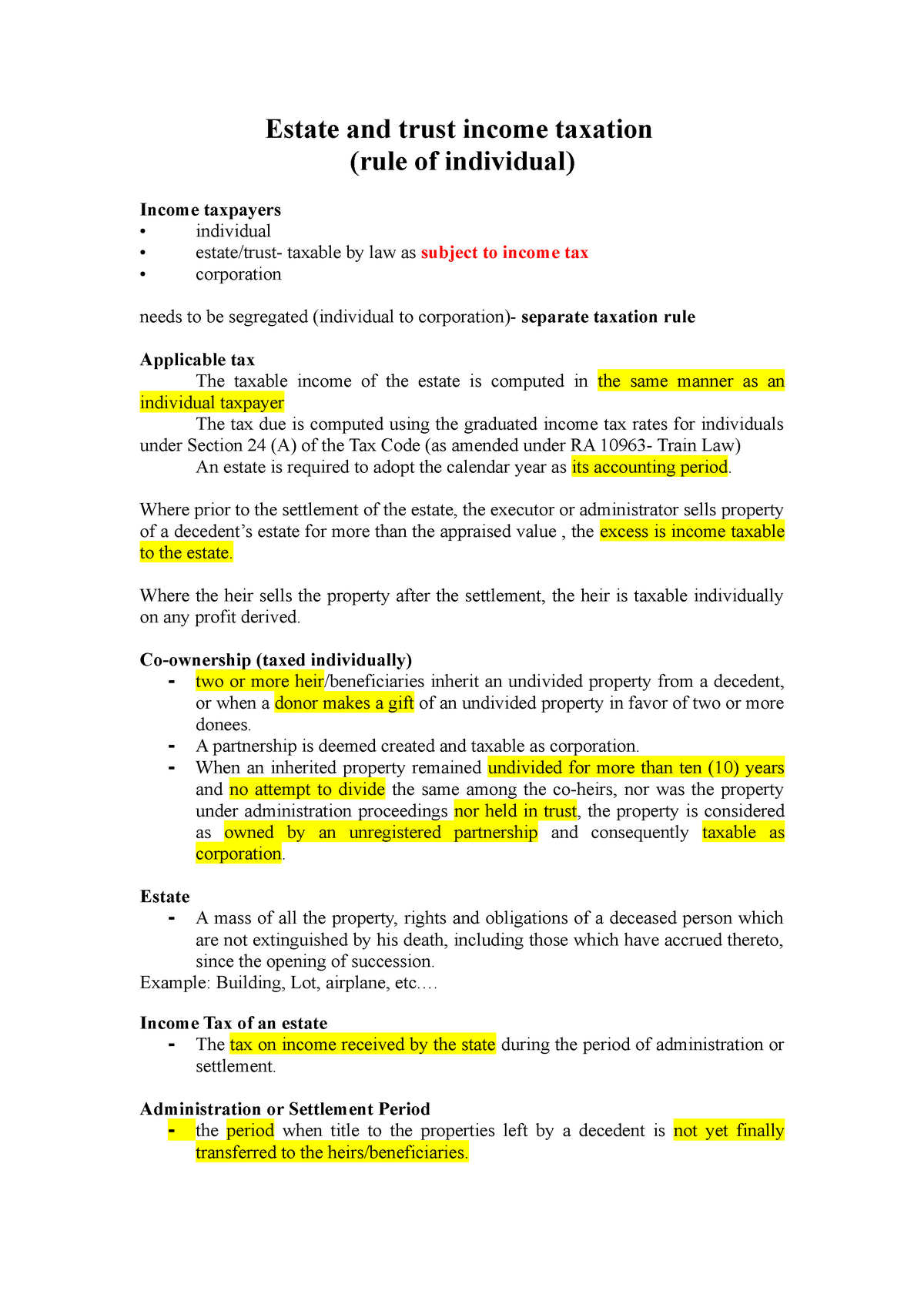

Estate And Trust Icnome Taxation Inc Tax Feu Studocu

Income Tax Diary Budgeting Income Tax Filing Taxes

Tax Season Is Here And Real Estate Investors Have To Prepare Use These Tax Saving Strategies Wil Savings Strategy Real Estate Investor Business Tax Deductions

All About Institutional Donors Proposalforngos Fundraising Strategies Grant Writing Proposal Writing

How The 7 Year Inheritance Tax Rule Works Inheritance Tax Tax Rules Inheritance

Distributable Net Income Tax Rules For Bypass Trusts Tax Rules Net Income Income Tax

Pin By Debbie Wolfe On Trusts Estate Tax Tax Return

Some Trust Distributions Are Subject To Tax Distributions Can Be Structured In Different Ways Revocable Living Trust Estate Planning Attorney Estate Planning

Creation And Taxation Of Private Trusts

What Is The Best Way To Leave An Ira Or 401 K Account To A Minor Savvy Parents Financial Savvy Accounting Ira

Testamentary Trust Estate Planning Family Trust Fund How To Plan

Trust Registration Service 2020 Trust Tax Rules Online Trust